How to to value a business in Vietnam? As the old saying goes “it’s worth as much as a buyer agrees to pay” which is quite true to some extent. However, to ensure the best deal and to have a realistic valuation, it is important to make a pragmatic valuation backed by reports and data to help support your valuation and negotiations. Two key questions that should be answered before selling include:

- How can I accurately determine the value of my business?

- Are there any steps I can take to increase the value of my business before selling it?

Valuing a business can be difficult. In this article we will look at some common ways to value a small business. Whether you are a buyer or a seller, this article should be useful. And of course for a professional valuation you may consider hiring a professional valuator or a financial advisor, who can help you to prepare a comprehensive valuation.

However for small sized businesses, often the buyer will not request a 3rd party valuation and they may feel that they have sufficient experience to value the business themselves backed with your valuations.

Table of Contents

Notification

Some of the professional valuation methods described below may be a little too advanced / detailed for micro- or small business. Therefore we have created another article with a more practical approach that might be more suitable for you in this link. And if you are looking to list or buy a business in Vietnam, take a look at our business for sale listings page or contact us for further information.

Why Would You Need To Value a Business?

There are several compelling reasons to raise capital for a business. Whether it’s covering initial expenses, ensuring a robust working capital, meeting regulatory requirements, facilitating strategic scaling or growth initiatives, or establishing a second location.

People might want to sell a business to cash in on its value, explore new opportunities, retire, or adapt to changing priorities. Strategic reasons, market conditions, or enticing offers from potential buyers can also influence the decision to fully sell a business.

Some business owners might sell equity (partial sell) as a strategic means to secure capital for growth, innovation, or financial needs without resorting to debt. Or they might simply want to receive some liquidity for personal reasons.

A Few Factors Regarding Pre-Revenue Business Start-Ups

Valuing a startup that has not yet begun to generate income can differ from established revenue-generating businesses.

Since a pre-revenue startup has not yet generated revenue, its value may not be immediately apparent. However, in such cases the value of a company is often determined by its potential for growth and success in the future. For more information on valuing a pre-revenue start up, take a look at this article.

A pre-revenue startup may possess valuable assets such as a skilled team, innovative product or service, growing market, or a lucrative market opportunity that can be used to gauge its potential value, despite not having yet proven its ability to generate revenue and profits.

What Methods To Use?

It is generally recommended to use multiple methods to value a business, as each method has its own strengths and weaknesses. Using multiple methods can help provide a more accurate and comprehensive valuation of the business.

If you’re a seller then it will help back your offered price, and if you’re a buyer then it’s good to have a more thorough analysis of the business to reduce risks. The most common methods used to value a business include: the income approach, the market approach, and the asset-based approach.

In this article, we will cover all these three methods, and some more. Keep in mind throughout this article that you have to choose the right method(s) for your specific business, in order to represent its true value.

How to value a fully operational business.

Book Value.

Particularly useful if your business has low profits but high assets, like stock, machinery, products, equipment, trademarks, patents, etc.. For small businesses this of course should not be the only method you use. And for certain types of businesses this method should not be used at all. For example: for service based businesses with limited assets or online businesses with not much IP / assets.

There are many things that this method is missing, for example some intangible assets, profitability, growth opportunities and future projections. However for buyers it is good to know for a kind of safety net, so that in the worst case scenario it is clear what assets can be sold to recover some investment. It’s very simple to calculate book value, in short, you just subtract the company’s liabilities from its assets.

Entry Cost Valuation Method

This is the predicted cost to set up a similar business. This method would include the cost of developing a customer base and reputation, building a brand, recruiting and training specialized staff, purchasing assets and licenses and developing products and services.

Seller’s Discretionary Earnings (SDE)

The SDE method is a popular method of valuing service based businesses as it does not take into account the value of the assets. It focuses on the profitability and cash flow of the business, often seen as the key indicators of its health.

For large businesses you would usually use EBITDA (earnings before interest, taxes, depreciation and amortization) — essentially, it’s the pure net profit of a business.

SDE is typically calculated by taking the net income (or net loss) which is mentioned on the company’s tax return … , plus a few additional items. These items normally include: interest expenses, depreciation expenses, the owner’s salary, and amortisation expenses. Some additional “add – backs” should be added also. Because they will increase your SDE, and ultimately your business valuation, so don’t forget to add them on.

Some common “add backs” include:

– Personal expenses.

– One off business expenses that are not recurring, for example a project that did not pay off, or hiring a one off service provider, designers to do 1 off designs etc.

– Any non-operational expenses.

The remaining amount is the SDE. To find the value of the business, you multiply the SDE by a number between 2 and 3.5.

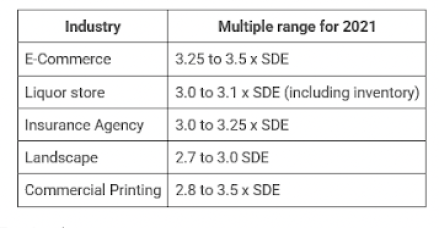

There’s a different SDE multiple for every industry. Your particular business’s SDE multiple will vary based on market volatility, your business location, your company’s size, assets and how much risk is involved in transferring ownership. The higher your SDE multiple, as you might expect, the more your business is worth:

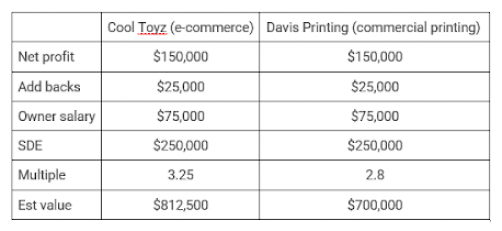

Here is an example below:

Another example would be:

A hair salon in a large city is for sale, and you are interested in buying it.

The salon’s income statement shows annual revenues of $125,000 and operating expenses of $75,000, resulting in an operating income of $50,000.

Additionally, the owner’s salary is $25,000 per year, and the salon purchased a new car for $3,750. The SDE for this business would be $50,000 + $25,000 + $3,750 = $78,750. If we assume a multiple of 2.75, the valuation for the business would be $78,750 x 2.75 = $216,562.50.

ROI-based Valuation Method.

Valuing a business based on return on investment (ROI) involves assessing the profitability potential in relation to the initial investment. For instance, if a business requires an initial investment of $100,000 and is expected to generate $20,000 in annual profits, the ROI would be calculated as ($20,000 / $100,000) x 100, resulting in a 20% ROI.

This percentage reflects the return on the investment relative to its cost. A higher ROI indicates a more lucrative investment, while a lower ROI may suggest a less favorable opportunity. This method provides a straightforward measure to evaluate the financial performance and attractiveness of a business for potential investors or buyers.

Discounted Cash Flow.

The Discounted Cash Flow (DCF) method values a business by estimating its future cash flows and then discounting them to their present value. This approach recognizes the time value of money, considering that a dollar today is worth more than a dollar in the future.

For example, if a business is expected to generate annual cash flows of $50,000 for the next five years, and the discount rate is 10%, the DCF calculation involves discounting each future cash flow to its present value. The sum of these present values represents the business’s estimated intrinsic value. The DCF method provides a comprehensive perspective on a business’s financial worth by considering the timing and risk associated with future cash flows.

Earnings Multiple Method

The Earnings Multiple Method values a business by applying a multiple to its earnings. For instance, if a business has annual earnings (Earnings Before Interest, Taxes, Depreciation, and Amortization – EBITDA) of $200,000, and the industry average earnings multiple is 4, the estimated business value would be $800,000 (EBITDA of $200,000 x earnings multiple of 4).

This method is commonly used for its simplicity and reflects the market’s perception of a business’s financial performance. A higher multiple suggests a favorable valuation, while a lower multiple may indicate potential risks or lower market confidence. The Earnings Multiple Method is valuable in quickly assessing a business’s worth based on its earnings relative to industry standards.

Here are examples of how it might be applied in different sectors:

- Retail Sector Example: A retail business with a consistent annual profit of $200,000 might be valued at a multiple of 4x earnings, resulting in a valuation of $800,000 ($200,000 * 4).

- Technology Sector Example: A technology startup with innovative products and strong growth potential might be valued at a higher multiple, say 8x earnings. If the annual profit is $500,000, the valuation would be $4 million ($500,000 * 8).

- Service Industry Example: A consulting firm providing specialized services with a steady profit of $150,000 could be valued at a multiple of 5x earnings, leading to a valuation of $750,000 ($150,000 * 5).

- Manufacturing Sector Example: A manufacturing company with a history of stable earnings at $1 million annually might be valued at a multiple of 6x, resulting in a valuation of $6 million ($1 million * 6).

- Restaurant Business Example: A popular restaurant chain with consistent earnings of $300,000 per year might be valued at a multiple of 3.5x earnings, yielding a valuation of $1.05 million ($300,000 * 3.5).

- Healthcare Industry Example: A healthcare service provider generating $800,000 in annual earnings could be valued at a multiple of 7x, leading to a valuation of $5.6 million ($800,000 * 7).

It’s important to note that the appropriate earnings multiple can vary based on factors such as industry norms, growth prospects, risk factors, and market conditions. Additionally, the Earnings Multiple Method is just one approach to business valuation, and it’s often used in conjunction with other methods for a more comprehensive assessment.

Comparable Sales Method

The Comparable Sales Method values a business by comparing it to similar businesses that have been recently sold. For instance, if similar businesses in the market have been sold for an average price of $500,000, and the business in question shares comparable characteristics, it could be valued in a similar range.

This method relies on the principle of market-driven valuation, where the selling prices of comparable businesses serve as benchmarks. Analyzing factors such as industry, size, location, and financial performance helps determine an appropriate valuation.

The Comparable Sales Method provides insights into a business’s worth based on real market transactions, making it a valuable approach for gauging the fair market value of a business.

Additional Thoughts.

Determining the required rate of return based on overall risk is essential. For example: in the U.S., a typical minimum target for more stable businesses is around 20%, equating to a 5x earnings over a 5-year period.

However, in Vietnam, Vietnamese banks often offer around a 6% return. As an expatriate in Vietnam, the inherent risk is higher, leading to an anticipated increase in the expected rate of return from investors. Based on our experience, the expected ROI in Vietnam tends to be notably shorter, falling in the range of 30-40%. This reflects the dynamic and potentially more volatile investment landscape.

We hope this article helps. If you’re seeking to assess the value of your own business or one that you are interested in, we would be happy to connect you with our partners who can assist. Should you have any inquiries, please feel free to reach out to us without hesitation.

Here is a link for business for sale listings in Vietnam.